Valuations and funding decreased

In Additive Manufacturing (AM), rapid innovation and substantial funding were driving forces in the past decade. However, the industry is now navigating in a more challenging environment. The once-thriving ecosystem, characterized by significant investments and flourishing ventures, faces headwinds due to overpromised expectations leading to disappointment and subsequently, the subdued valuation of publicly traded companies in the sector. The top three AM technology startups raised over EUR 1.2 billion in total funding before going public in a SPAC deal. Although their valuation at the time of the IPO in 2021/22 was at EUR 4.6 billion, it has sharply dropped to only EUR 0.5 billion today.

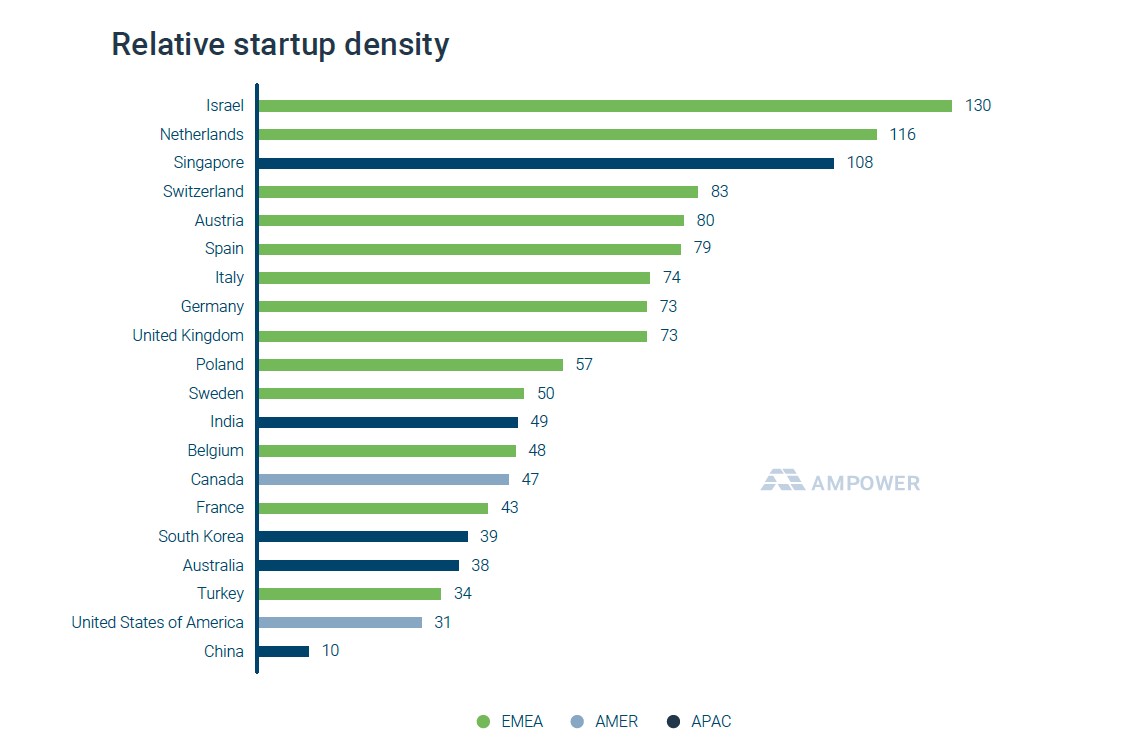

Israel, Netherland and Singapore have the highest startup density

Unsurprisingly, the US boasts the largest number of Additive Manufacturing startups, while Israel and the Netherlands lead in AM startups relative to their countries’ economic power. A surprising second in the Asia Pacific region after China and a newcomer in recent years is India, with over 166 AM startups listed.

While the number of new AM technology startups annually has declined over the past decade, the number of new application-driven AM startups have steadily increased. Additive Manufacturing enables new applications, and while established companies often struggle to fully embrace AM, startups are likely to take the risk associated with a completely AM-driven approach to manufacturing applications.

Applications and user are driving the industry

While startups are currently facing challenges in raising money, investors find attractive opportunities due to lower valuations. However, the number of startups with a truly new value proposition is lower than in the past. Overall, startups with a customer focus and application-centric approaches are poised to have successful funding rounds in the next couple of years.